Shopping on Rhode Island's new insurance exchange

A 29-year-old navigates the choices for health plans

As the story shows, there is a lot of basic information that is not necessarily readily available to the consumer – such as how to choose a primary care provider. What are the qualities you look for? How do you evaluate the medical practice you want to be seen by? Health care is more than just having an insurance card.

PROVIDENCE – Evan McKay, 29, newly promoted to a manager’s position at Olga’s Cup + Saucer on Point Street, sat down last week on his day off to try and figure out what his options were to buy health insurance on the new online marketplace, HealthSourceRI, which opens on Oct. 1.

In an interview four months ago with the reporter, McKay had voiced enthusiasm about being able to buy affordable health insurance as a result of the Affordable Care Act.

For the first time in 10 years, he had explained, with health insurance coverage, he would finally be able to see a primary care professional on a regular basis.

Approaching his third decade of life, McKay had said he realized it was important to have a medical record and go to someone who knows your body.

The barrier before had been the cost of health insurance, which was too expensive, and the fact his current job, where he had worked for three years, had not offered him health benefits [before now, with his promotion]. “They didn’t offer health insurance [to all the workers], because it’s very expensive, obviously,” he said.

In his small room in a shared second-floor apartment off Broadway, McKay attempted to navigate the HealthSourceRI website, as the ConvergenceRI reporter and photographer observed.

When McKay arrived at the HealthSourceRI landing page, he was pleasantly surprised to see a photo of his boss as one of the images of smiling Rhode Islanders used to promote the “friendliness” of the website.

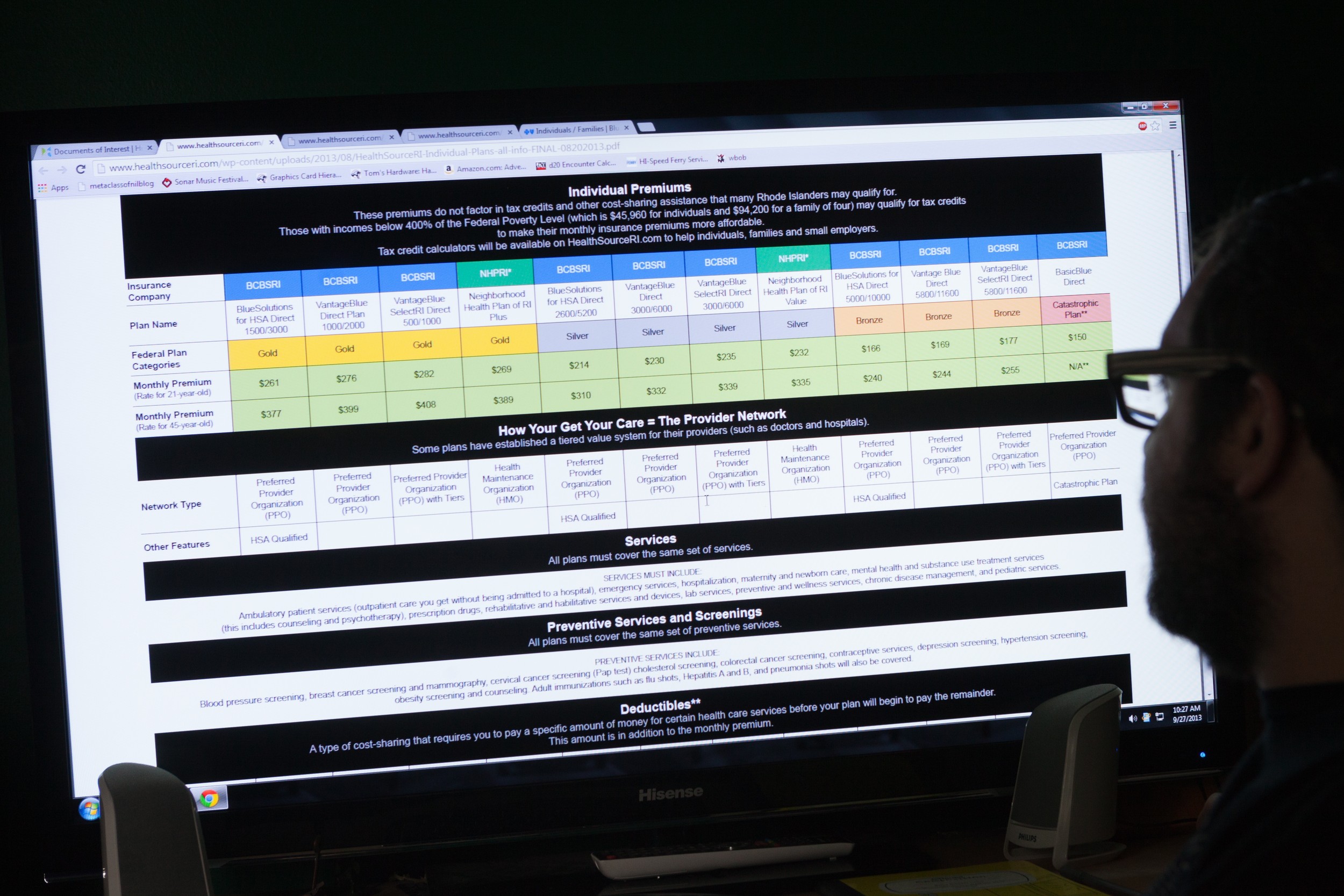

The first calculation McKay did was to see how much his tax credit would be, plugging in his annual income. On a monthly premium of $281, his tax credit would be $98, resulting in a total premium of $183, according to the calculator.

That turned to be the easiest part. Even with a four-foot screen attached to his computer, McKay found it difficult to hone in on the array of numbers to compare the various plans offered.

He quickly noticed that the lower premiums came with higher deductibles, and his choice would need to find a balance between cost and risk. He wanted to know more about the differences there were between the health insurance companies, which he couldn’t tell from the website. He looked at a figure of paying 10 percent for a hospital emergency room visit as a co-pay and asked out loud: “Ten percent of what?” wondering why hospital costs could not be made more transparent.

Also, McKay wondered about the maximum out-of-pocket expenses, the combination of deductibles and co-payments. “Suppose I don’t use all of the amount in one year. Is there a carry over to the next year? Or, do you start again with the higher number?”

Good question to ask, the reporter agreed.

How do you shop for a primary care provider?

A more basic question remained unanswered for McKay: “How do you shop for a primary care provider? I don’t know how you go about that. Angie’s List? Are there reviews on stuff like that? Word of mouth? Advertising?”

McKay decided to call the HealthSourceRI contact center and ask them, putting the call on speakerphone for our benefit. The person who answered suggested that McKay call back after Oct. 1, or consult with the health insurance websites, to see what doctors were listed as providers for each plan. After a few minutes of polite but unhelpful conversation, McKay thanked him and hung up.

“He really didn’t know what he was talking about,” McKay concluded, who had wanted to know if there were any public sources that measured the performance of primary care providers.

McKay said that he was a friend of a nurse practitioner, and he would ask her for recommendations.

McKay asked the reporter for his opinion of how to shop for a primary care provider. The reporter suggested that McKay consider the kind of practice he wanted to be seen by – a team-based, patient-centered medical home, by a medical group, or by a single practitioner.

“What’s a patient-centered medical home?” McKay responded, having never heard of the term before.

The reporter then explained the concept as a team-based approach to primary care. A patient may be seen by a physician’s assistant, or a nurse practitioner, depending on the nature of the presenting problem.

That’s make sense, McKay said. “The primary care providers I know all say that they are totally swamped.”

After 45 minutes of going through the numbers, comparing the prices of numerous plans and deductibles, McKay realized that it was going to take a lot more “homework” on his part to figure things out.

“I’ve got some homework to do,” he said. “Maybe it’s more daunting to me, because I’m not insured.” McKay said he was going to enlist the help of his girlfriend. “She’s a lot better about logistical stuff like this, and we can look at it together,” he said.

McKay is scheduled to sit down with his employer, Olga Bravo, on Tuesday afternoon, and work together at figuring out the best health insurance options on the exchange.

In terms of questions, what did McKay want to be prepared to ask her about?

“I want to know just how much she is willing to pay per week, and to give me a hard number on that, so I know how to base my shopping,” he said.

Next Week: Evan McKay goes shopping with his employer.